The Value of the Canadian Beef Cattle Check-Off

The Canadian Beef Cattle Check-Off is a mandatory levy of $2.50 per head collected from beef cattle producers when they market their cattle, with the exception of Ontario, who remains at $1. The check-off generated $17.2 million in check-off and $1.2 million in import levy in 2020/21 for research, marketing and promotion activities on behalf of the entire industry.

The beef check-off and import levy provide industry funding for the Beef Cattle Research Council (BCRC) responsible for the industry’s national research and extension program, Canada Beef tasked with market development and promotion in domestic and international markets, and public and stakeholder engagement, which works to manage issues and build public trust in Canadian beef cattle production.

Why measure the value?

You deserve to know how your investments are REALLY doing

Measuring the impact of invested check-off and import levy dollars allows producers to know exactly what their money is doing, and how well it’s working for them. This evaluation takes place every five years by the Canadian Beef Check-Off Agency.

The Agency completed the first comprehensive evaluation of returns to national check-off dollars in March 2010, reporting on fiscal years 2005/06 to 2007/08. After the formation of Canada Beef, the board made a commitment to update the study every five years to provide greater transparency and accountability back to producers.

As industry has adapted to the changing landscape, the Canadian Beef Check-Off Agency wanted to address key questions including producer benefit cost ratio (BCR); the extent to which check-off funded investment has affected the industry’s competitiveness and demand for Canadian beef; and optimal allocation of funds.

The second study, completed in July 2016 reported on fiscal years 2011/12 to 2013/14. The 2022 study utilized coefficients and elasticities from the entire dataset and calculated the BCRs on a five-year average from 2016 to 2021. Since the last full study, there have been several structural changes within the industry:

- The introduction of the import levy

- The development of the Public and Stakeholder Engagement program in 2016

- The increase in the national check-off from $1 to $2.50 per head by 2018, with the exception of Ontario, who remains at $1

What did the study find?

A marginal BCR greater than one indicates the last dollar of investment returns more than $1 in benefits. Large BCRs is a sign of under-investment and the Agency should invest more to lower the BCR to closer to one without reducing it below the target of unity.

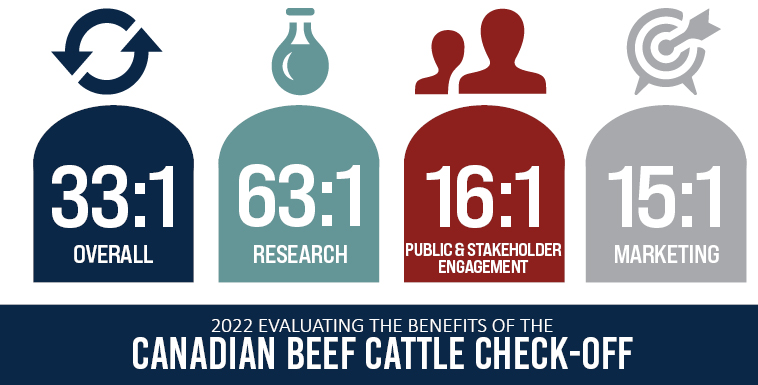

This study reports that national research, marketing and promotion activities resulted in the following benefit cost ratios:

- Research had a BCR of $63.2, compared to $34.5 and $46 in the Rude (2011/12 to 2013/14) and Cranfield (2005 to 2008) studies respectively. Historical studies only evaluated carcass weight, while this study added more indicators.

- Domestic Marketing (including the import levy) had a BCR of $15.4, compared to $17 and $8 in the Rude and Cranfield studies respectively.

- Public and Stakeholder Engagement had a BCR of $16, no comparisons are available.

The average benefit cost ratio was expected to decline following the increase in the national check-off from $1 to $2.50 per head in 2018, with the exception of Ontario, who remains at $1. There is generally an inverse relationship between the amount of money spent on a promotion or research activity and its marginal BCR. This is due to what economists refer to as “diminishing marginal returns” which means as more money is spent on an activity, the marginal or incremental gains from it, increase at a decreasing rate. This concept helps explain why as investments increase that BCR’s typically decline. The fact that the BCRs are still positive confirms there was under-investment in research, marketing, and promotion activities for the Canadian beef cattle industry. The increased investment is still providing a positive return to producers. Any BCR above one (1:1) indicates that an additional dollar in expenditures will increase benefits above a dollar and thus suggests increasing expenditures. It is clear with respect to research, marketing and PSE expenditures, far greater benefits have accrued than costs. Even though the BCR for research has increased, the change did not make enough of an impact to warrant a check-off allocation change to research, or any of the service providers. Much of the BCR change can be attributed to the new methodology used to conduct the 2022 study.

How does Canada compare with other countries?

This compares with recent reviews on beef cattle check-off returns in Australia ($6.2) and the United States ($11.9).

BCRs in Australia and the United States have both increased since their last study, indicating under-investment. The BCR for Canadian beef cattle check-off is on the high end of the range of values reported in previous studies for other regions and commodities.

In comparison to other countries Canada has a smaller beef check-off to invest in marketing and research at $17.2 million in check-off and $1.2 million in import levy in 2020/21.

| Country | Check-off levy | Applies to imports? | 2020/21 Revenue (millions) |

| Canadian beef | CDN$2.50 per head marketed | Yes | CDN$18.4 |

| Australia beef | A$5 per head marketed | No | A$65.6 |

| New Zealand beef | NZ$5.20 per head on cattle slaughtered | No | NZ$15.4 |

| U.S. beef | US$1 per head marketed | Yes | US$42.8* |

Review All Studies

| 2022 Study | 2018 Update | 2016 Study | 2010 Study | |

| Full Report | Full Report | Full Report | Full Report | |

| Fact Sheet | Fact Sheet | Fact Sheet | Fact Sheet | |

| Q & A | Q & A | Q & A | ||

| Supplemental | Supplemental |